Newsmatro

The Ministry of Finance has issued a comprehensive clarification in response to misleading information circulating on social media platforms regarding income tax regulations. The government affirmed on Monday that there are no new changes pertaining to income tax rules coming into effect from April 1.

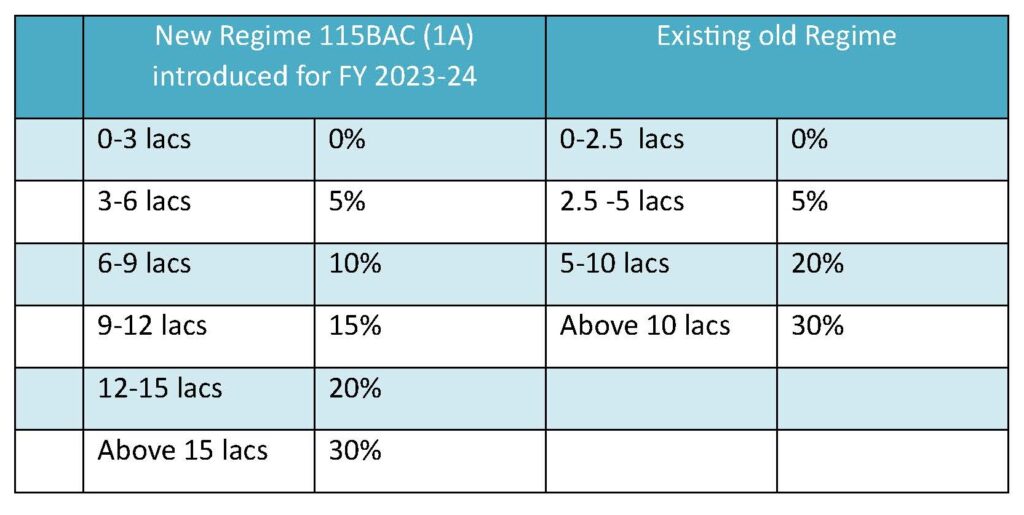

A detailed statement released by the Ministry of Finance aims to dispel any misconceptions surrounding the new tax regime. The statement underscores that this regime applies to individuals other than companies and firms, by default, beginning from the financial year 2023-24, with the corresponding assessment year being AY 2024-25.

The Ministry emphasized that while the new tax regime offers significantly lower tax rates, it does not provide the benefits of various exemptions and deductions available under the old tax regime, except for standard deductions such as Rs 50,000 from salary and Rs 15,000 from family pension.

However, taxpayers have the flexibility to choose the tax regime they deem most advantageous for their situation, even though the new regime is set as the default option. Furthermore, individuals without any business income have the liberty to select the regime for each financial year, providing the option to switch between the old and new tax regimes as per their preferences.

With the commencement of the new financial year, individuals are presented with the choice to adhere to either the new or old tax regime. The old regime, characterized by multiple deductions and exemptions under various sections, offers a more intricate structure with higher tax slabs in certain brackets.

In contrast, the new regime features lower tax rates while eliminating most deductions and exemptions. While it simplifies the filing process, it may not suit everyone’s financial requirements.

Under the new tax regime, individuals earning up to Rs 7.5 lakh are exempt from paying taxes, providing a significant advantage. Additionally, those with incomes up to Rs 10 lakh and no investments can benefit from the lower tax slabs offered by this system.